Your 401(k) + Pension Experts

A NATIONAL LEADER FOR OVER 33 YEARS IN THE DESIGN AND ADMINISTRATION OF PENSION, PROFIT SHARING AND 401(K) PLANS.

Larry Shippee

ASA, EA, MSPA

Founder and CEO

Larry Shippee brings an extensive depth of experience to the employee benefits industry. He has held the position of Chief Actuary for a national benefits consulting firm and has also served as Chief Actuary for a major life insurance company that specializes in the employee benefit marketplace. In 1987 he founded The Benefits Consulting Group, with the mission of providing a specialized, full-service approach to retirement plan support.

“Most businesses do not have the time or resources to devote to the operation and management of their employee benefit plans. We are focused and committed to minimizing the burden on the employer, taking care of the day to day tasks that many large financial service providers simply cannot. We work closely with your financial advisors and accountants to form a team dedicated to maximizing your objectives.”

Larry Shippee

Founder and CEO

401(K) + Profit Sharing

The most common retirement plan used today allows employees to save for retirement with the convenience of payroll reduction.

Defined Benefit + Cash Balance Plans

A guaranteed retirement benefit that allows for the largest tax deferrals which maximizes benefits for older employees.

Actuarial Consulting

From actuarial analysis to expert testimony, we have the depth of experience to help resolve complex issues.

What Our Clients Say

"The Benefits Consulting Group has proven to be a valuable partner for me and my clients. They solve for the best solution in each case and seamlessly manage the ongoing administration."

William Seibold

Seibold Wealth Management

MashIt

"The Benefits Consulting Group has been our partner for over 15 years. They are proactive, thorough and answer my questions in very understandable language even when the topic is technical in nature. I always can count on them to do the highest quality work."

Christopher T. Bertschy

McCarthy Bertschy & Associates

"Managing a retirement plan is very complicated. The Benefits Consulting Group provides the expertise we need and lack in house to effectively manage a retirement plan. They are a great fit for us."

Everett Bell

Midwest Fence Corporation

YesSuits

Latest Blog

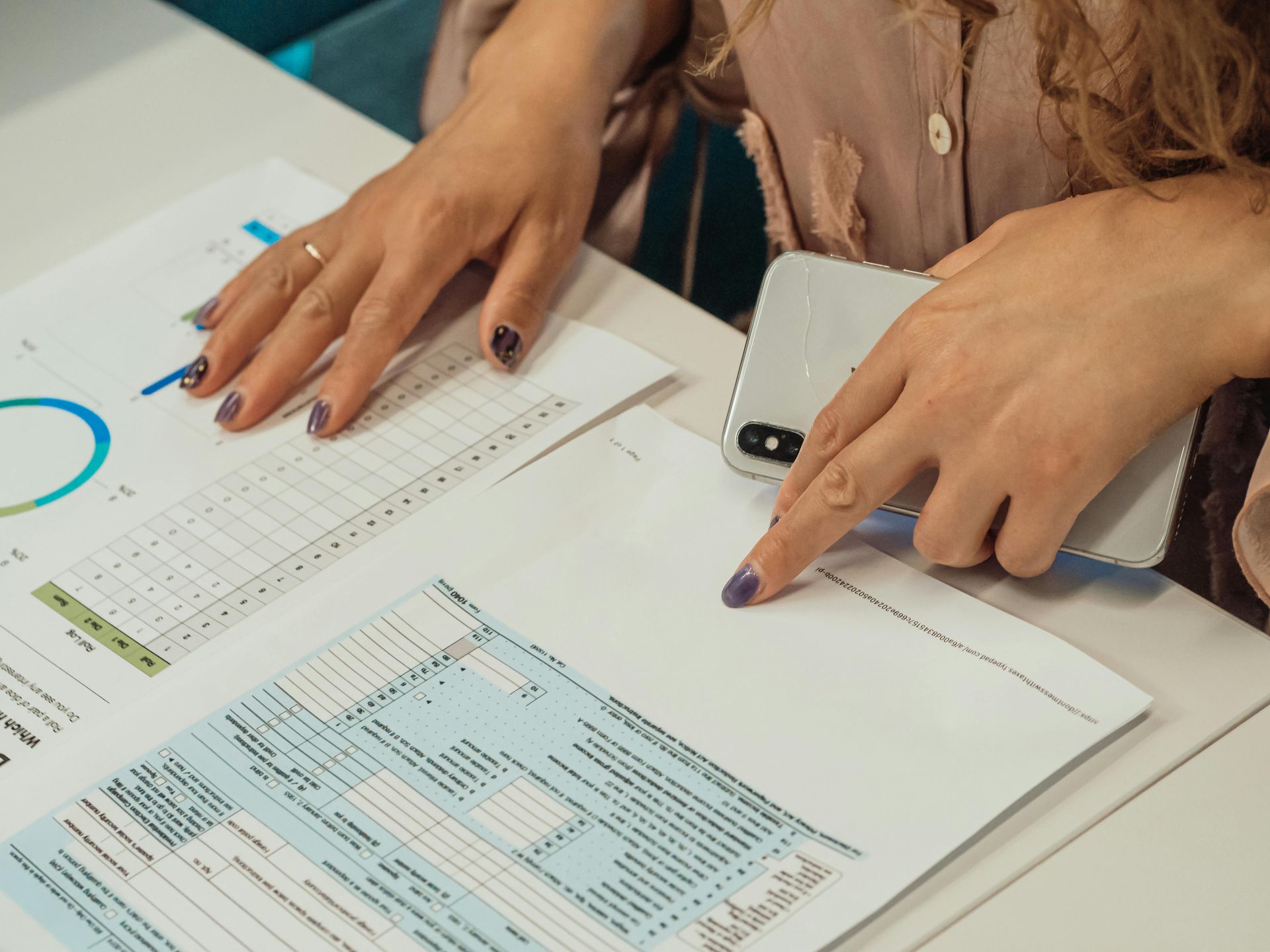

Want to know if your current plan is leveraging all tax advantages?

Are you tired of spending too much time on your 401(k)?

Wondering if the 401(k) fees you are paying are reasonable?

Contact us for a complimentary 401(k) Check Up and find out if you can get improved results.

MENU

GET IN TOUCH

Tel: (312) 427-9140

Fax: (312) 427-9757

53 West Jackson Boulevard

Suite 864

Chicago, IL 60604

All Rights Reserved | Site by Fix8