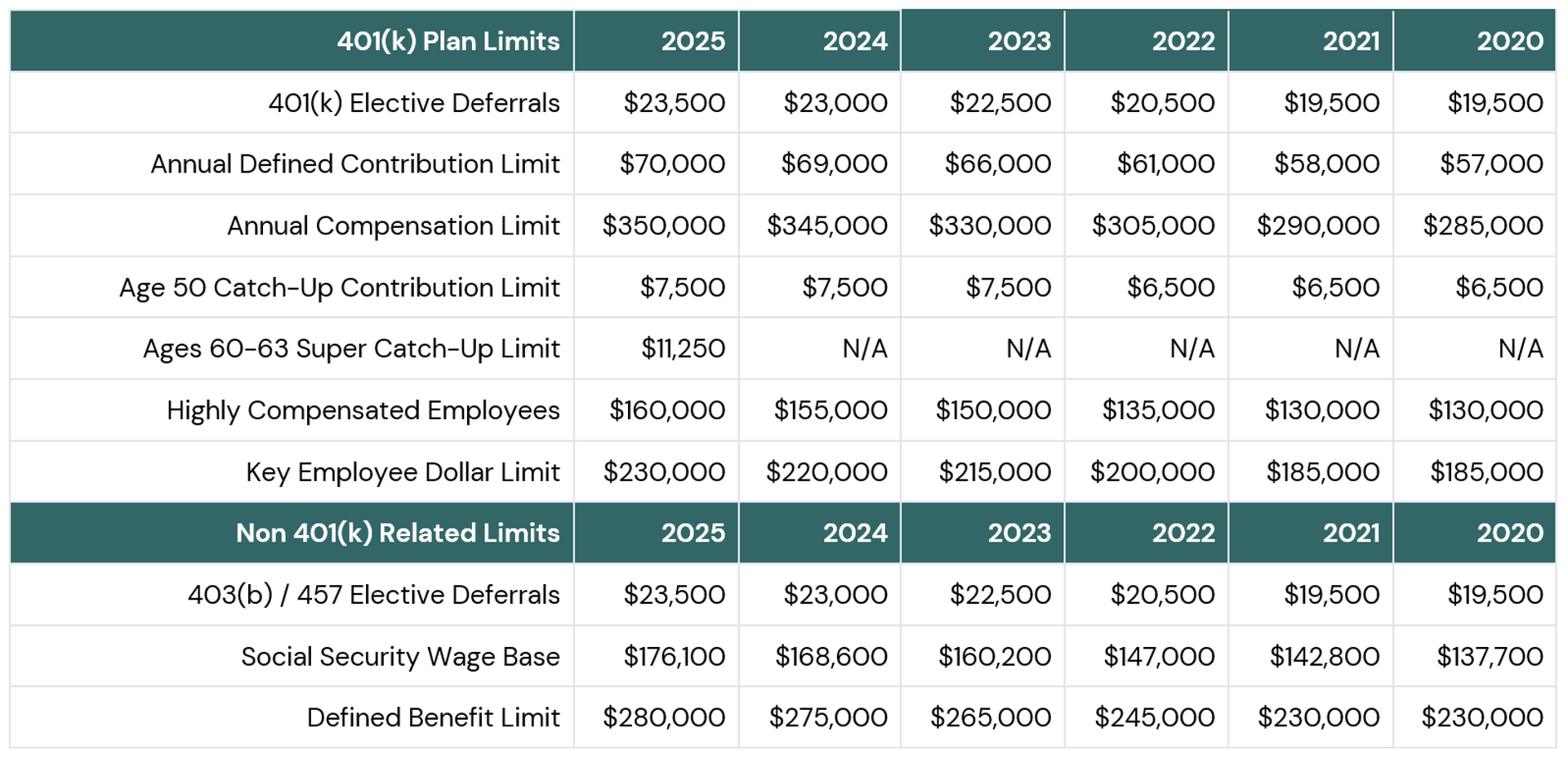

PLAN LIMITS

2025 401(k) Plan Limits

Want to know if your current plan is leveraging all tax advantages?

Are you tired of spending too much time on your 401(k)?

Wondering if the 401(k) fees you are paying are reasonable?

Contact us for a complimentary 401(k) Check Up and find out if you can get improved results.

MENU

GET IN TOUCH

Tel: (312) 427-9140

Fax: (312) 427-9757

53 West Jackson Boulevard

Suite 864

Chicago, IL 60604

© 2025

All Rights Reserved | Site by Fix8