BLOG

Blog

December 6, 2024

Employee Elective Deferral Contributions Employees under the age of 50 who participate in 401(k) or 403(b) plans will be able to contribute up to $23,500 during 2025, which is an increase from the 2024 maximum of $23,000. The limit on catch-up contributions for people over 50 years old will remain at $7,500 for 2025; however plans implementing the new “super catch-up” rule will allow people between the ages of 60 – 63 to make additional catch-up contributions up to a maximum of $11,250. That means workers who are 50 or older can contribute up to $31,000 from their salary during the 2025 plan year (except for workers utilizing the super catch-up rule who can contribute up to $34,750.) For more on the super catch-up provision, please click here . DC Plan Annual Additions Limit The limitations for DC plans include both employee and employer contributions (safe harbor, match, profit sharing, etc.) The limit on contribution totals is $70,000 per participant for the 2025 plan year, which is an increase from the 2024 limit of $69,000. So, that’s a maximum of: o $77,500 including catch-up contributions for those over 50 years old o $81,250 including super catch-up contributions for those in the 60 – 63 age range Compensation Employee compensation limit for calculating contributions will rise from $345,000 to $350,000 and the HCE’s (Highly Compensated Employees) threshold for nondiscrimination testing will increase from $155,00 to $160,000. As a reminder, employers should convey these changes to their employees to encourage participation in the plan. It is also important to make sure your payroll system is up to date with the new 2025 employee contribution limits prior to the start of the year. To understand how these changes may affect your plan contact your pension consultant . To see the full chart of the 2025 Plan Limits, click here .

November 21, 2022

In 2023, employees will be able to contribute up to $22,500 a year, up from $20,500 to 401(k), 403(b) and other tax-advantaged employer savings plans. The limit on catch-up contributions for people 50 or older also rose to $7500 from $6500. That means a worker over 50 years old can contribute a maximum of $30,000 next year. The total contribution limit, which includes employer contributions, increased from $61,000 to $66,000. So, for those over 50 years old who take advantage of the catch-up contribution, that’s a maximum total of $73,500. Employee compensation limit for calculating contributions will rise from $305,000 to $330,000 and the HCE’s (Highly Compensated Employees) threshold for nondiscrimination testing will increase from $135,00 to $150,000. We have not seen these large increases in decades, we can thank inflation for that! Employers should convey these changes to their employees to encourage increased participation. To understand how these changes may affect your plan contact your pension consultant here . To see the full chart of the 2023 Plan Limits, click here .

April 9, 2021

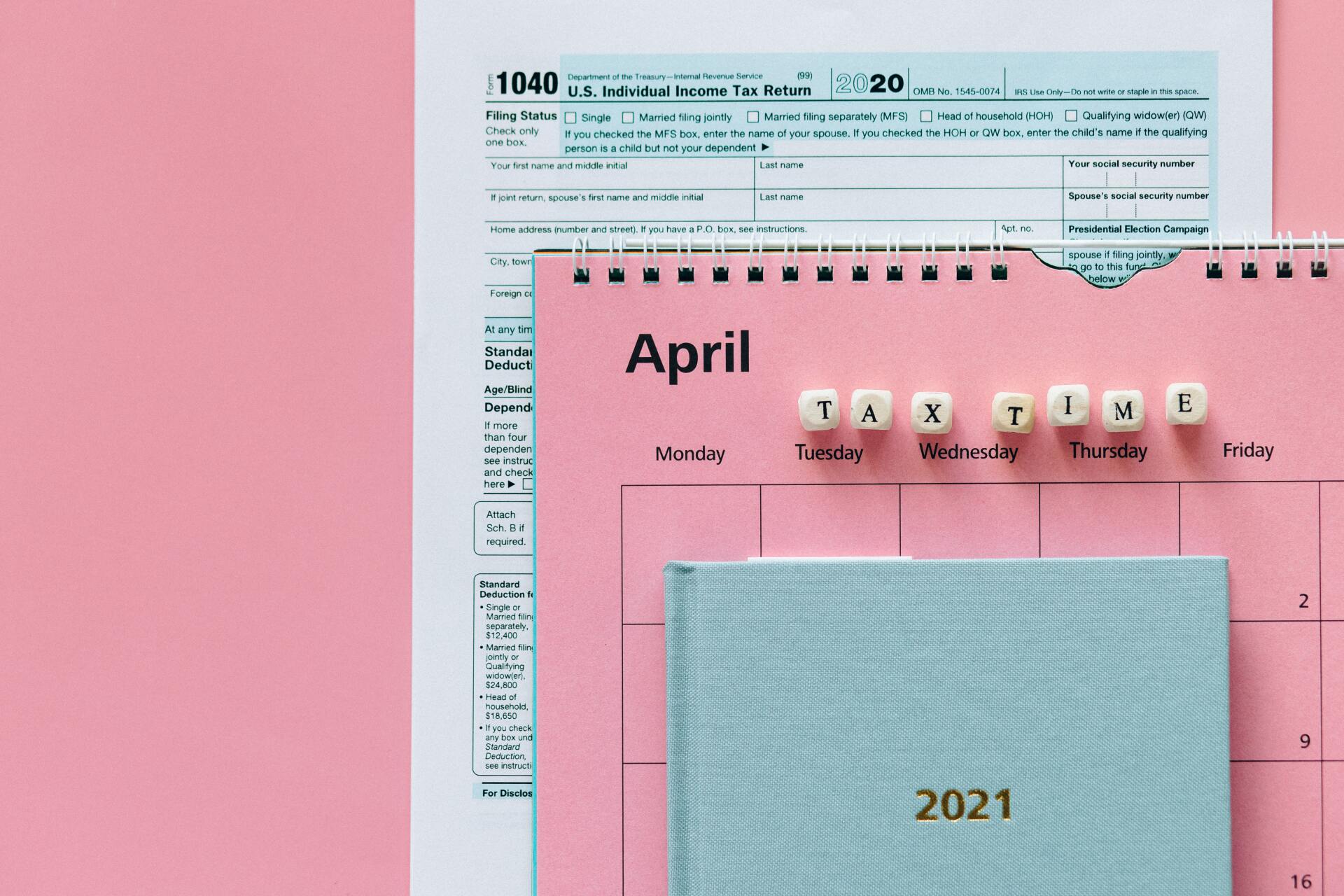

The total of all salary deferrals a participant makes to various retirement plans – including 401(k), 403(b), SARSEP and SIMPLE IRA plans – is limited to $19,500 (plus an additional $6,500 if age 50 or over) for 2020. If an individual defers more than this limit for 2020, the excess deferral amount plus earnings must be distributed by April 15, 2021. Excess salary deferrals not withdrawn by April 15 are taxable in 2020 and again when withdrawn. The date to remove excess salary deferrals has not been extended. Individuals who made salary deferral contributions to two or more retirement plans in 2020 may be most at risk for exceeding the deferral limit. Use our Interactive Tax Assistant to help determine how to correct excess salary deferrals.RMD’s) are back on for 2021. Participants in qualified retirement plans (401(k)’s, IRA’s, etc.) used to be required to begin taking distributions once they reached age 70 ½. That requirement has now been changed to age 72. So if you turned 72 in 2021 or before, be sure that you take the proper distributions by the required due date. That date is December 31, 2021 if you turned 72 prior to 2021 and it’s April 1, 2022 if you turn 72 in 2021. Contact us for more information.

March 15, 2021

It is now tax season so business owners are huddling with their accountants to get the bad news. Accountants are looking for ways to lessen the pain. That is where Qualified Retirement Plans (401(k), Profit Sharing, Defined Benefit and Cash Balance Plans) come in. For over 30 years accountants have come to us for ways to reduce the check to Uncle Sam and for over 30 years the answer has always been the same. Yes, you can do it, but not for last year. This year that has all changed. For the first time you can set up a qualified retirement plan AFTER the end of the year but use it to reduce your tax burden for LAST year. That is right. 2020 is the first year you do not have to take action by December 31! And you can make contributions to the plan all the way up to the due date of your tax return, even the extended due date, and still take the deduction on your 2020 return. And, by the way, do not miss the tax credit for setting up a new plan. That is TAX CREDIT , not tax deduction. Call us for details.

Want to know if your current plan is leveraging all tax advantages?

Are you tired of spending too much time on your 401(k)?

Wondering if the 401(k) fees you are paying are reasonable?

Contact us for a complimentary 401(k) Check Up and find out if you can get improved results.

MENU

GET IN TOUCH

Tel: (312) 427-9140

Fax: (312) 427-9757

53 West Jackson Boulevard

Suite 864

Chicago, IL 60604

© 2025

All Rights Reserved | Site by Fix8