What?! I Can Lower My 2020 Tax Bill Now?

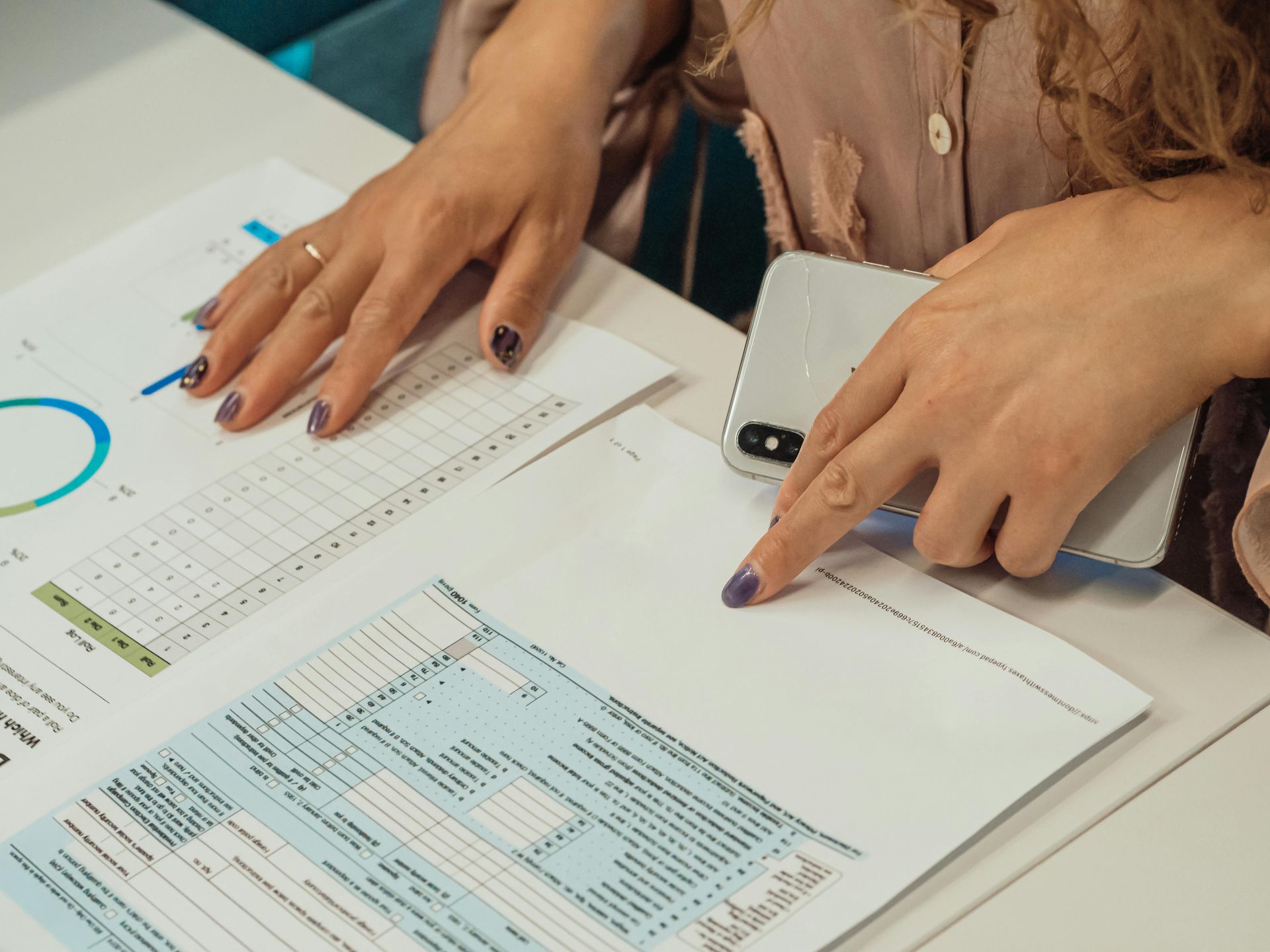

It is now tax season so business owners are huddling with their accountants to get the bad news. Accountants are looking for ways to lessen the pain. That is where Qualified Retirement Plans (401(k), Profit Sharing, Defined Benefit and Cash Balance Plans) come in. For over 30 years accountants have come to us for ways to reduce the check to Uncle Sam and for over 30 years the answer has always been the same. Yes, you can do it, but not for last year.

This year that has all changed. For the first time you can set up a qualified retirement plan AFTER the end of the year but use it to reduce your tax burden for LAST year. That is right. 2020 is the first year you do not have to take action by December 31! And you can make contributions to the plan all the way up to the due date of your tax return, even the extended due date, and still take the deduction on your 2020 return.

And, by the way, do not miss the tax credit for setting up a new plan. That is

TAX CREDIT, not tax deduction. Call us for details.

Want to know if your current plan is leveraging all tax advantages?

Are you tired of spending too much time on your 401(k)?

Wondering if the 401(k) fees you are paying are reasonable?

Contact us for a complimentary 401(k) Check Up and find out if you can get improved results.

MENU

GET IN TOUCH

Tel: (312) 427-9140

Fax: (312) 427-9757

53 West Jackson Boulevard

Suite 864

Chicago, IL 60604

All Rights Reserved | Site by Fix8