Super Catch-Up

Understanding the new IRS catch-up limit increase.

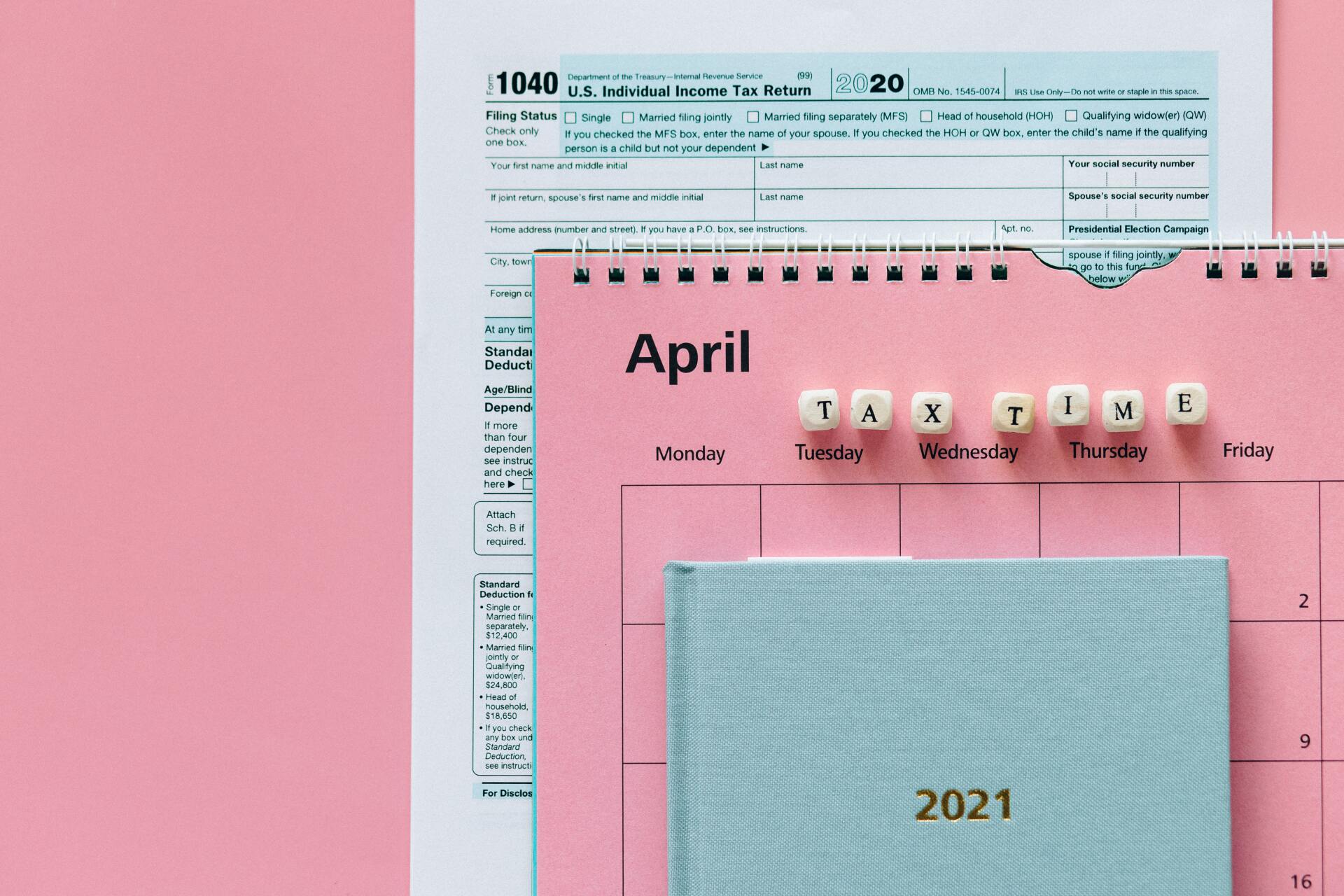

Starting January 1, 2025, Plan Sponsors of 401(k) or 403(b) plans have the option to allow participants between the ages of 60 and 63 as of the close of the taxable year to increase their catch-up contribution to a maximum of $11,250.

This age-based increased catch-up limit is also known as the “Super Catch-Up.” It is our current understanding that if your plan already allows for catch-up contributions, implementing the Super Catch-Up is optional.

Some important things to consider for Plan Sponsors interested in this feature are:

- Your plan document will need to be amended.

- If you make Employer matching contributions, will the Super Catch-Up contributions also be matched?

- Your payroll system will need to identify who is eligible to take advantage of the Super Catch-Up rule.

- How to communicate the change to all plan participants.

Please email or call our office if you would like more information or would like your plan to include the Super Catch-Up.

Want to know if your current plan is leveraging all tax advantages?

Are you tired of spending too much time on your 401(k)?

Wondering if the 401(k) fees you are paying are reasonable?

Contact us for a complimentary 401(k) Check Up and find out if you can get improved results.

MENU

GET IN TOUCH

Tel: (312) 427-9140

Fax: (312) 427-9757

53 West Jackson Boulevard

Suite 864

Chicago, IL 60604

All Rights Reserved | Site by Fix8